Bamzonia is an insolvent island in the middle of the Pacific that urgently needs our help. Crime and pollution have flooded the streets, businesses have gone under, jobs are rarer than hens’ teeth and peculiar purple mushrooms are growing in surprising places. Out of the angst and despair a Yoda like figure called the Guru appears; he wants us to help him get Bamzonia back on track. To do this we need to complete challenges, gain knowledge and, step-by-step, get the island bouncing with prosperity and success once again.

Basically Bamzonia is a self-contained, online 3D gaming platform divided into three levels aimed at building the functional skills of children from 8-18 years. It is made up of 47 lessons over three levels accredited by the Pfeg and has been designed to give students a more detailed understanding of the financial issues they are inevitably going to encounter as they get older. The first level, Discover, is aimed at primary children, Level 2 is Build for 11-14 years and Live for 14-16 years is the third level. It’s organised into two main parts, the education and game modules.

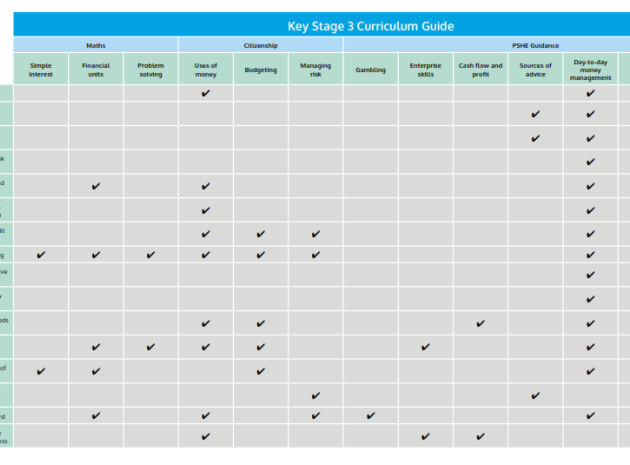

The detailed lesson plans in the education module cover a vast array of financial topics such as ‘at the bank’, ATMs, internet and telephone banking, debit and credit cards, savings, needs and wants, budgeting, buying financial products, gambling and investing, starting your own business, wages and salaries, payslips, tax, borrowing, debt, making a will, pensions, insurance, buying your own home and how to be a good consumer. The lessons are well written throughout and include some thought-provoking and testing challenges and scenarios and activities for individual, paired and grouped work, with audio files if required. There are further resources linked to some interesting articles and videos. You can download a helpful Teacher Guide and this contains all you need to know to get to grips with the resource (it’s also only 17 pages so refreshingly to the point).

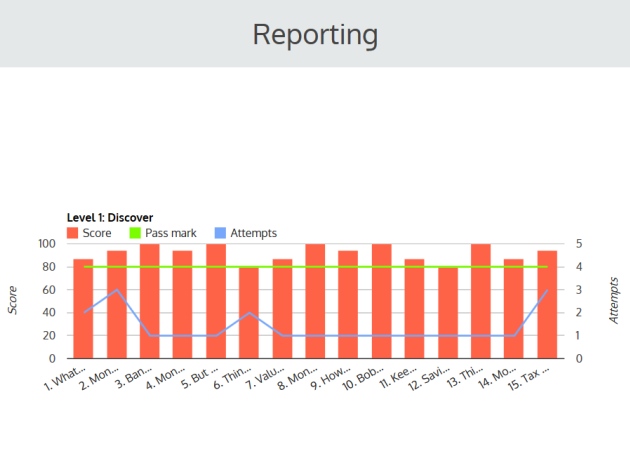

Students are able to engage with factual information slides and embedded scenarios, with plenty of discussion points along the way. At the end they take a 15-question multiple choice quiz, which gives them credits (currency) if they do well. Marking and monitoring is all automatic, so relax. The credits can then be used to play a game to rescue the island by completing quests. The game has two key elements: mini arcade type games and home squares, the main element. These are fun, challenging and are set in a realistic 3D SimCity style environment with a real sense of atmosphere. The idea is that the more credits you can earn the more you can build and invest to transform your Bamzonia island by buying items that will influence the health, wealth and happiness of folks there. Students can also earn credits from the Guru. There are leader boards, which can be seen by friends to encourage some friendly competition, and certificates for achievement. A very handy Dashboard enables teachers to regulate access to the lessons, assign pupils to classes and keep a beady on progression. Pupils can use it to access their unlocked lessons, chart their own progress and print off their certificates. This is a clever idea and one that students will engage with. It’s an adventure, it’s a challenge and it aims to put money management skills into real-life settings so students can play their part in rejuvenating an island that has hit rock bottom.

You might be wondering whether the gaming aspect makes this a ‘dog and pony show’ resource. No, this is a complete online course that has real substance to it and plenty to offer for delivering key practical financial knowledge and skills. Although I am not entirely convinced by the need to portray the island as a kind of post-apocalyptic Los Angeles, I sort of see how this is the bait to catch the attention of the user. The cost of the resource is a few pounds short of £1,000, which might leave you winded, especially when you consider there are other resources online that don’t cost a penny – but the fact is, they don’t offer anything like as much as Bamzonia can in terms of actual teaching and learning. Anything missing? Well, my wish list would include video interviews with young people about money and consumerism as well as interviews about the pitfalls and experiences they have had in the world of money and the positive outcomes of participating in a financial literacy program.

Bamzonia has many uses and not just for the classroom. It’s ideal for an after-school club activity and is perfect for homework and learning beyond school too. Sign up for a free trial and see whether the shoe fits for you. I think it has a potentially powerful part to play in helping students grow into money savvy and financially responsible adults.

Learn More and Get Involved!

Instant PFE Solution for schools - http://bamzonia.com/instant-pfe-solution-for-schools/

Bamzonia’s lessons and lesson plans - http://bamzonia.com/education-module/

Register for a month’s full access - http://v2.bamzonia.com/register/register-school/